Blog

Click here to go back

Off-Cycle Revalidations

Off-Cycle Revalidations

Provider Enrollment Off-Cycle Revalidations-Skilled Nursing Facilities: Report Expanded Ownership, Management, & Related Party Data

The form CMS-855A has been revised effective October 1, 2024. Beginning on Oct. 1st all SNFs that are initially enrolling, revalidating, reactivating, or undergoing a change of ownership must submit the new form with the new SNF attachment completed.

CMS will revalidate enrolled skilled nursing facilities (SNFs) from October - December 2024 to collect data on ownership, managerial, and related party information. Your Medicare Administrative Contractor will send you a revalidation notice:

• One-third of SNFs will get notices in October

• Two-thirds will get notices in November or December

Click here to view the new Medicare Enrollment Application from CMS.

Click here for additional guidance for SNF Attachment.

Click here for provider enrollment information.

If you need assistance, please contact our office. Call us at (270) 726-4033.

Rhonda Houchens, Director of Operations

Resources: KY Medicaid Ancillary Supplemental Schedule, Beneficial Ownership Information Registry

Kentucky Medicaid Ancillary Supplemental Schedule

As of 7/1/24, Kentucky Medicaid no longer reimburses for ancillaries (Oxygen, PT, OT, SLP, Lab, Xray). Kentucky Medicaid now includes an ancillary add-on $ amount in your Medicaid rate. The ancillary add-on $ amount included in the 7/1/24 rate is based on previously billed ancillary charges. The ancillary add-on will be adjusted every 7/1. As of 7/1/25, the ancillary add-on will be based on a spreadsheet that will be completed and submitted with your Medicaid Cost Report.

Go to Helpful Downloads, Nursing Facility, and they are in the middle of the list.

Click here to view the ancillary schedules and instructions from the Myers and Stauffer website.

Beneficial Ownership Information Registry (BOIR)

Skilled Nursing Facilities: Report Your Expanded Ownership, Management, & Related Party Data

Effective January 1, 2024, many companies in the United States must report information about their beneficial owners—the individuals who ultimately own or control the company—to the Financial Crimes Enforcement Network (FinCEN), a bureau of the U.S. Department of the Treasury.

Who has to report?

• Existing companies: Reporting companies created or registered to do business in the United States before January 1, 2024 must file by January 1, 2025.

• Newly created or registered companies: Reporting companies created or registered to do business in the United States in 2024 have 90 calendar days to file after receiving actual or public notice that their company’s creation or registration is effective.

Who does not have to report?

• Twenty-three types of entities are exempt from beneficial ownership information reporting requirements, including publicly traded companies, nonprofits, and certain large operating companies.

• Small Entity Compliance Guide

Click here to view the Small Entity Compliance Guide.

When do I report?

• If your company was created or registered prior to January 1, 2024, you will have until January 1, 2025 to report BOI.

• If your company is created or registered in 2024, you must report BOI within 90 calendar days after receiving actual or public notice that your company’s creation or registration is effective, whichever is earlier.

What information is needed?

• Name

• Date of Birth

• Address

• The identifying number and issuer from either a non-expired U.S. driver’s license, a non-expired U.S. passport, or a non-expired identification document issued by a State.

Click here to view the U.S. Department of Treasury website.

Click here to file a BOI Report.

Medicaid Quality Incentive Program

Medicaid Quality Incentive Program

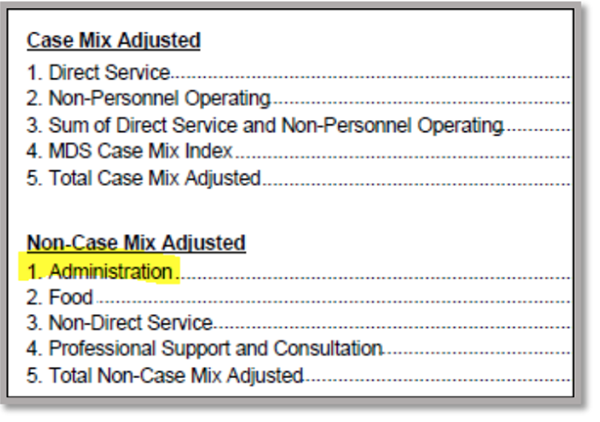

For FY2025 (7/1/24) providers received the full provider tax assessment rate of $41.43. This amount is built into the Administration line of your 7/1/24 Medicaid rate.

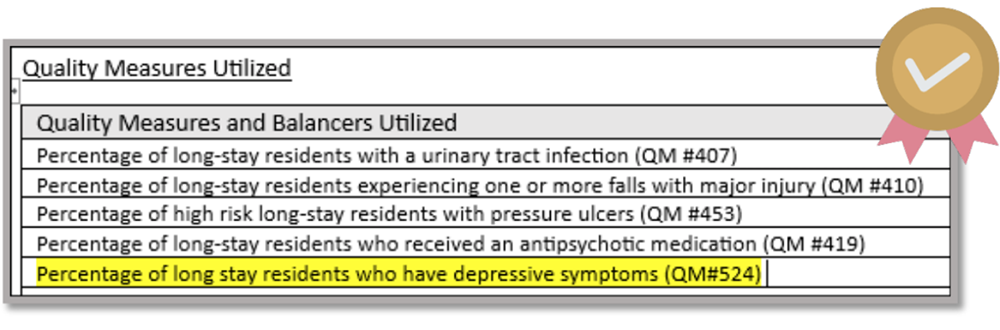

Beginning with FY2026 (7/1/25), the Department for Medicaid Services (DMS) will implement a phase-in of the Quality Incentive Program. The provider tax add-on allowance of $41.43 will be reduced and a quality pool will be created. Providers will earn a quality add-on per diem based on the DRAFT measures below. The highlighted measure is up for discussion.

Myers & Stauffer will post a draft Score card of the quality measures in the portal within the next 2 weeks.

Click here to view a printable PDF.

If you need assistance, please contact our office. Call us at (270) 726-4033.

Sarah McIntosh, President

Resources: CMS notifies SNFs of Updates

FFS SNF ABN

CMS revised the SNF ABN, Form CMS-10055, and the form instructions. The SNF ABN form and instructions are located at the link below in the download section. It is available for immediate use, but will be mandatory for use on 10/31/2024.

Click here for complete details.

CMS notifies SNFs: From the latest CMS MLN Connects Newsletter

Skilled Nursing Facilities: Report Your Expanded Ownership, Management, & Related Party Data

CMS will revalidate enrolled skilled nursing facilities (SNFs) from October – December 2024 to collect data on ownership, managerial, and related party information. Your Medicare Administrative Contractor will send you a revalidation notice:

• One-third of SNFs will get notices in October

• Two-thirds will get notices in November or December

You must report this data on the revised Medicare Provider Enrollment Application Form (CMS-855A). We’ll post the revised form and guidance later in September; see Become a Medicare Provider or Supplier.

Click here to view the newsletter.

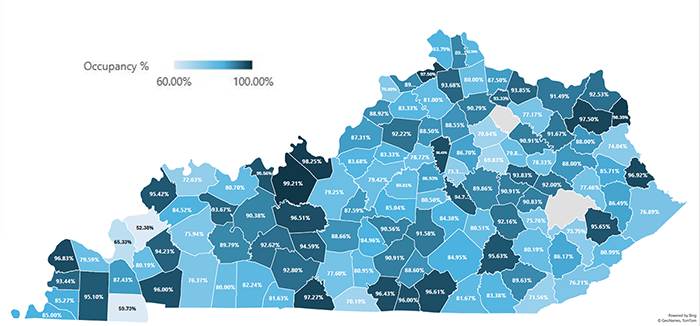

Kentucky SNF Occupancy Percentage Map, July 2024

Kentucky SNF Occupancy Percentage Map

July 2024

According to CMS data, the average occupancy for nursing homes in Kentucky is 85.45%.

Click here to view a high quality PDF of the map.

If you need assistance, please contact our office. Call us at (270) 726-4033.

Sarah McIntosh, President

Resources: Annual DDE/PPTN Recertification Is Due, Personal Needs Allowance Increase

Reminder: Annual DDE/PPTN Recertification Is Due

BAs a reminder, each year, providers must recertify each Direct Data Entry (DDE) and Professional Provider Telecommunications Network (PPTN) user's access.

To recertify, complete and fax the Annual DDE PPTN Recertification Form beginning on:

• June 1, 2024 – Home Health & Hospice providers

• July 1, 2024 – Part A providers

• August 1, 2024 – Part B providers

According to our records, several providers have not yet submitted the form. The final deadline is August 31, 2024.

If you don't complete the recertification process timely, we must terminate your DDE/PPTN access. Once terminated, you will need to submit the J15 DDE PPTN Application/Reactivation form to regain access and normal application processing times will apply.

Click here to complete the Recertification Form today.

Personal Needs Allowance (PNA) Increase

Kentucky Medicaid members retain a Personal Needs Allowance (PNA) for personal and incidental needs while under the care for long-term services. As a result of House Bill 6 (RS 2024), the PNA increased from $40 to $60.00 per month effective July 1, 2024.

This increased amount for PNA will be deducted from the LTC member’s gross income when determining the patient liability for Nursing Facilities (NF), Intermediate Care Facilities for Individuals with Intellectual Disabilities (ICF/IIDs), Institutional Hospice (IHP), and Institutional Program of All Inclusive Care for the Elderly (IPACE).

If you have any questions regarding this change, please contact DMS.Eligibility@ky.gov.

Fiscal Year 2025 Skilled Nursing Facility Prospective Payment System Final Rule (CMS 1802-F)

Fiscal Year 2025 Skilled Nursing Facility Prospective Payment System Final Rule (CMS 1802-F)

On July 31, 2024, the Centers for Medicare & Medicaid Services (CMS) issued a final rule updating Medicare payment policies and rates for skilled nursing facilities under the Skilled Nursing Facility Prospective Payment System (SNF PPS) for fiscal year (FY) 2025.

CMS is updating SNF payment policies, which would result in a net increase of 4.2%, or approximately $1.4 billion, in Medicare Part A payments to SNFs in FY 2025. In addition to the SNF PPS rate update, CMS is rebasing and revising the SNF market basket to reflect a 2022 base year. CMS is finalizing several changes to the PDPM ICD-10 code mappings and rule changes to CMS’ enforcement policies to impose more equitable and consistent civil monetary penalties (CMPs) for health and safety violations. CMS is finalizing updates to the SNF Quality Reporting Program (QRP) to better account for adverse social conditions that negatively impact individuals’ health or health care by adding four new social determinants of health (SDOH) items and modifying one SDOH assessment item for the SNF QRP. Additionally, CMS is finalizing a policy requiring SNFs included in the SNF QRP to participate in a process to validate data submitted under the SNF QRP beginning with the FY 2027 SNF QRP. The final rule also contains updates to the SNF VBP program.

7/1/24 Kentucky Medicaid Rate Letters

7/1/24 Kentucky Medicaid Rate Letters

USPS Mailing and Portal Access

Per Myers and Stauffer, hard copies were sent via USPS on Monday, July 22nd. All rate letters will be posted to the Myers and Stauffer portal on Tuesday, July 23rd. Please send your rate letters to our office for review.

The Ancillary add-on calculation is being reviewed by Myers & Stauffer. Stay tuned for updates regarding possible revised rate letters.

If you need assistance, please contact our office. Call us at (270) 726-4033.

Sarah McIntosh, President

Resources: Kentucky Medicaid Changes, PDPM CMI and more

7/1/24 Kentucky Medicaid Changes

Bedhold days reimbursed at a maximum of 30 days per calendar year due to hospitalization.

Bedhold days reimbursed at a maximum of 10 days during a calendar year for leaves of absence other than hospitalization.

ALL Bedhold days reimbursed at 75% of the facility’s rate. Regardless of the SNF census being above 95% or greater for the calendar quarter.

Click here to see Current Regulation 065.

Click here to see Proposed Regulation 065.

Kentucky Medicaid Ancillary Add On as of July 1, 2024

Effective July 1, 2024, ancillary services will be included in the per diem rate calculations and will not be paid outside the per diem rate.

Ancillary services include the following:

• Speech Therapy

• Occupational Therapy

• Physical Therapy

• Oxygen Services

• Laboratory

• X-ray

The ancillary add on will be calculated every July 1. Effective July 1, 2024, the ancillary add on will be calculated as the Medicaid ancillary payments from the prior year divided by Medicaid days. Effective July 1, 2025 and after, the ancillary add on will be calculated as the prior year Medicaid ancillary charges divided by the total Medicaid days, limited to the posted ancillary fee schedule amounts per unit.

Myers & Stauffer will be sending out the final Ancillary Add-on Supplemental Schedule the week of July 29th.

Click here to see Proposed Regulation 065.

PDPM CMI

For rates effective July 1, 2024, the PDPM case-mix index shall be phased in using the following schedule:

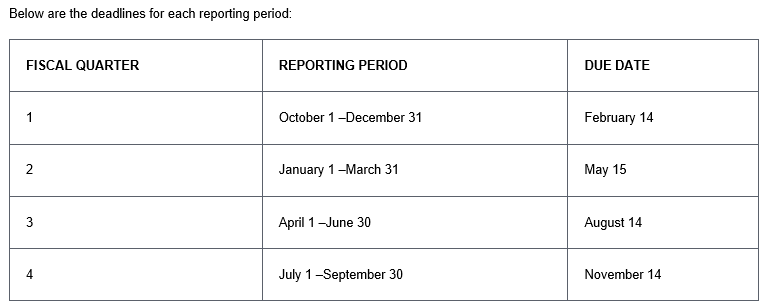

Annual DDE/PPTN Recertification

Annual DDE/PPTN Recertification

Each year, providers must recertify each Direct Data Entry (DDE) and Professional Provider Telecommunications Network (PPTN) user's access.

What this means to you:

• Complete the Annual DDE PPTN Recertification Form per the instructions. See link below.

• Fax the completed form to CGS per the timeline below.

The recertification timeline will begin on:

• June 1, 2024 for Home Health & Hospice providers

• July 1, 2024 for Part A providers

• August 1, 2024 for Part B providers

*The final deadline to submit the completed form is August 31, 2024. CGS will deactivate user IDs that aren't recertified on or before August 31, 2024.

FAX to:

Kentucky Part A.........................1.615.664.5943

Kentucky Part B.........................1.615.664.5917

Ohio Part A................................1.615.664.5945

Ohio Part B................................1.615.664.5927

Personal Needs Allowance Increase at 7/1/24 - Has a Few Delays

Personal Needs Allowance Increase at 7/1/24 - Has a Few Delays

As part of House Bill 6, Medicaid is increasing the Personal Needs allowance from $40 to $60. Below is the wording from the House Bill.

• (24) Personal Needs Allowance: Included in the above General Fund 5 appropriation is $3,775,000 in each fiscal year to increase the Personal Needs Allowance 6 from $40 to $60 per month effective July 1, 2024. Notwithstanding KRS 45.229, any 7 portion of General Fund not expended for this purpose shall lapse to the Budget Reserve 8 Trust Fund Account (KRS 48.705). Mandated reports shall be submitted pursuant to Part 9 III, 24. of this Act.

Several SNF’s have noted that the Personal Needs Allowance increase did not occur for all Medicaid recipients. Per Medicaid these changes will be implemented July 22-26.

Kentucky Skilled Nursing Facility Rate Training

Kentucky Skilled Nursing Facility Rate Training

For those who were unable to attend the webinar hosted by Myers and Stauffer on behalf of the Department of Medicaid Services on May 30th, 2024, or for those who would like to review the materials, the recording, slides, and Q&A are available for download. You can access these resources on the Myers and Stauffer, Kentucky Provider page under the Helpful Downloads section, specifically under Nursing Facility.

Click here to visit the Myers and Stauffer website.

Do you have questions? You may call us at (270) 726-4033 or email us at: accountants@hargisandassociates.com

Sarah McIntosh, President

Resources: Capital Rate Component, Personal Needs Allowance, Scams and CBSA

Capital Rate Component

National Valuation Consultants, Inc (NVC) completed the appraisal process for Kentucky nursing facilities. These reappraisals will be used to determine the facility’s capital component as of July 1, 2024. On average, SNFs are seeing a decrease in their capital rate component of $1. The decrease is related to the inflation factors applied since the 2019 appraisal. There are discussions on how the capital rate components can be calculated differently prior to the next capital rate calculation that will be completed in 2029.

Personal Needs Allowance Increase at 7/1/24

As part of House Bill 6, Medicaid is increasing the Personal Needs allowance from $40 to $60. Below is the wording from the House Bill.

(24) Personal Needs Allowance: Included in the above General Fund 5 appropriation is $3,775,000 in each fiscal year to increase the Personal Needs Allowance 6 from $40 to $60 per month effective July 1, 2024. Notwithstanding KRS 45.229, any 7 portion of General Fund not expended for this purpose shall lapse to the Budget Reserve 8 Trust Fund Account (KRS 48.705). Mandated reports shall be submitted pursuant to Part 9 III, 24. of this Act.

Medical Records Request Scam

CMS identified phishing scams for medical records. This may include scammers faxing you fraudulent medical records requests to get you to send patient records in response. See CMS Medicare Learning Network link below

Click here to see the CMS Medicare Learning Network.

KY Medicaid CBSA changes effective July 1, 2024

907 KAR 1:065 Payments for price-based nursing facility services states that on July 1 of each year, the department shall utilize the most recent Federal Office of Management and Budget’s core based statistical area (CBSA) designations to classify an NF as being in an urban or rural area for Medicaid rate setting purposes.

An updated OMB bulletin no. 23-01 was published July 21, 2023 and will impact nursing facilities July 1, 2024 rates in the following counties:

• Hancock and Henderson will transition from Urban to Rural Status

• Ballard, Carlisle, Lawrence, Livingston, McCracken, and Nelson will transition from Rural to Urban status

If you have questions regarding this please contact our office. (270) 726-4033 or email us at: accountants@hargisandassociates.com

PDPM Resident Roster Reports, Reappraisals & Link to Webinar

PDPM Resident Roster Reports

The 1st and 2nd Preliminary PDPM Roster Reports are available and in your facility’s portal.

Myers & Stauffer Reappraisals

As of 5/24/24, Myers and Stauffer is sending out facility appraisal reports in batches. The remaining batches should be sent by 5/31/24. Be sure to review your appraisals. If you disagree with the output, you have 30 days to appeal.

Myers & Stauffer Webinar

Important Changes are coming to Medicaid Therapy Service Payments

As of 7/1/24, Department for Medicaid Services (DMS) will be paying for therapies (Medicaid only patients) and oxygen as a line item in the Medicaid rate. Myers & Stauffer will be hosting a WEBINAR to discuss the changes.

Thursday, May 30, 2024: 9:30 a.m. - 11:00 a.m. CST, (10:30 a.m. - 12:00 p.m. EST)

We're also excited to share that our very own Sarah McIntosh and Kyle Fritsch will be joining the webinar as panelists! You won't want to miss this important session, as it will be packed full of important information.

Do you have questions? You may call us at (270) 726-4033 or email us at: accountants@hargisandassociates.com

Sarah McIntosh, President

Resources: (SNF) Value-Based Purchasing Program VBP, Medicaid Personal Needs Allowance Increase

Skilled Nursing Facility (SNF) Value-Based Purchasing Program VBP

The SNF VBP program is a pay-for-performance program. As required by statute, CMS withholds 2% of SNFs’ Medicare fee-for-service (FFS) Part A payments to fund the SNF VBP Program. This 2% is referred to as the “withhold”. CMS is then required to redistribute between 50% and 70% of this withhold to SNFs as incentive payments depending on their performance in the program.

CMS is proposing several operational and administrative proposals as part of this year’s rule. Operationally, CMS is proposing the adoption of a measure retention and removal policy. CMS is also proposing updating the case-mix methodology for the Total Nurse Staffing measure and a review and correction policy update.

Nursing home providers should note that the fiscal 2025 SNF PPS proposal is up for public comment right now through May 28, CMS officials said.

Click here to visit the CMS website to learn more.

Personal Needs Allowance Increase at 7/1/24

As part of House Bill 6, Medicaid is increasing the Personal Needs allowance from $40 to $60. Below is the wording from the House Bill.

(24) Personal Needs Allowance: Included in the above General Fund 5 appropriation is $3,775,000 in each fiscal year to increase the Personal Needs Allowance 6 from $40 to $60 per month effective July 1, 2024. Notwithstanding KRS 45.229, any 7 portion of General Fund not expended for this purpose shall lapse to the Budget Reserve 8 Trust Fund Account (KRS 48.705). Mandated reports shall be submitted pursuant to Part 9 III, 24. of this Act.

J15 DDE PPTN: Application/Reactivation Form

J15 DDE PPTN: Application/Reactivation Form

On February 27, 2024, CGS deployed an online version of the J15 DDE PPTN: Application/Reactivation Form

The online form:

• Allows users a more accurate and efficient process to obtain a User ID for DDE/ PPTN access

• Eliminates errors encountered with the hardcopy form

• Includes an electronic rather than a handwritten signature field A request ID is generated when you submit the application.

If the user(s) is located outside of the United States, please send a copy of the network connectivity diagram to CGS.EDI@CGSadmin.com, and include your request ID in the subject line of the email. Note: CGS will reject paper forms received after March 27, 2024.

CGS DDE/PPTN Recertification Form

Annual DDE/PPTN Recertification

Each year, providers must recertify each Direct Data Entry (DDE) and Professional Provider Telecommunications Network (PPTN) user's access.

What this means to you:

• Complete the Annual DDE PPTN Recertification Form per the instructions. See link below.

• Fax the completed form to CGS per the timeline below.

The recertification timeline will begin on:

• June 1, 2024 for Home Health & Hospice providers

• July 1, 2024 for Part A providers

• August 1, 2024 for Part B providers

*The final deadline to submit the completed form is August 31, 2024. CGS will deactivate user IDs that aren't recertified on or before August 31, 2024.

FAX to:

Kentucky Part A.........................1.615.664.5943

Kentucky Part B.........................1.615.664.5917

Ohio Part A................................1.615.664.5945

Ohio Part B................................1.615.664.5927

Medicaid Timely Filing of Claims

Medicaid Timely Filing of Claims

The Department for Medicaid Services sent a Provider Letter on March 8, 2024, regarding timely filing of claims. The timely filing edit has been suspended for several years and was resumed on 3/8/24. The provider letter mentioned that Medicaid must receive claims no more than 12 months from the date of service. The provider letter did not mention that when the timely filing edit was resumed, coinsurance claims would be affected as well. The timely filing edit for coinsurance claims is 6 months from the Medicare remit date. Just like inpatient claims there will be circumstances when the patient was not Medicaid approved within 6 months or 1 year. If the patient was not approved for Medicaid within 6 months from the Medicare remit date, you will need to submit documentation demonstrating timely filing to Medicaid. Below is the mailing address to submit the timely filing documentation to.

• Claims Submission: P.O. Box 2101, Frankfort, KY 40602-2101

• Coinsurance

• 6 months from Medicare remit date

• Send UB-04, Medicare remit, and Medicaid screen shot to show proof of timely filing.

Do you have questions? You may call us at (270) 726-4033 or email us at: accountants@hargisandassociates.com

Sarah McIntosh, President

Federal Minimum Staffing Rule Finalized

Federal Minimum Staffing Rule Finalized

CMS is finalizing a total nurse staffing standard of 3.48 hours per resident day (HPRD), which must include at least 0.55 HPRD of direct registered nurse (RN) care and 2.45 HPRD of direct nurse aide care.

Click here to visit the White House website to learn more.

Click here to visit the CMS website to learn more.

Resources: Physician Fee Schedule, Kentucky Medicaid, Medicare Updates and more

Physician Fee Schedule Changes of 3/9/2024

On March 9, 2024, President Biden signed the Consolidated Appropriations Act, 2024, which included a 2.93 percent update to the CY 2024 Physician Fee Schedule (PFS) Conversion Factor (CF) for dates of service March 9 through December 31, 2024.

Click here to visit the CMS website to learn more.

Kentucky Medicaid to Utilize PDPM CMI at 7/1/2024

The Kentucky Department for Medicaid Services will be implementing Patient Driven Payment Model (PDPM) rate methodology effective July 1, 2024. The first Preliminary Resident Listing for 1/1/24-3/31/24 should be available in the Myers & Stauffer web portal at the end of April. Please be watching for this report.

Contact Hargis if you would like us to update your 7/1/24 Projected Medicaid rate with your 1/1/24-3/31/24 PDPM CMI. You may call us at (270) 726-4033 or email us at: accountants@hargisandassociates.com

Providers Required to Submit Managing Employee Information to Provider Enrollment Records Immediately

This notice provides clarification that SNF providers should not wait for the revalidation to submit any missing medical director or administrator via the Change of Information (COI) submission as soon as possible.

KY Medicaid Reappraisals

National Valuation Consultants, Inc (NVC) has completed the appraisal process for nursing facilities. These reappraisals will be used to determine the facility’s depreciated replacement value. This value will be used to calculate the capital component on the quarterly rates, effective with the July 1, 2024 rate. The NVC reports will be released to Providers by May 31st. If you have questions or need assistance reviewing these reports let us know. All clients, please forward a copy of the reappraisal report to your Client Manager.

Skilled Nursing Facility Prospective Payment System Proposed Rule

For FY 2025, CMS proposes updating SNF PPS rates by 4.1% based on the proposed SNF market basket of 2.8%, plus a 1.7% market basket forecast error adjustment, and a negative 0.4% productivity adjustment.

Click here to visit the CMS website to learn more.

UPDATE: Change to Medicaid Therapy Reimbursement for Medicaid Only Patients

UPDATE: Change to Medicaid Therapy Reimbursement for Medicaid Only Patients

Medicaid reimburses therapy and laboratory/radiology services separately for Medicaid only patients (patients without Medicare B). Department for Medicaid Services (DMS) is tentatively planning to cease reimbursing therapy separately and include therapy as a line item in the 7/1/24 SNF rate.

Also, DMS is tentatively planning to cease reimbursing oxygen separately and include oxygen as a line item in the 7/1/24 SNF rate.

This will be advantageous for SNFs in several ways.

1. Medicaid can pay higher overall rates. The inclusion of therapy increases the Upper Payment Limits.

2. SNFs will no longer have to bill Medicaid for therapies.

3. SNF’s will no longer have to bill Medicaid for oxygen.

4. SNFs will no longer have to obtain therapy prior authorizations.

3. SNF’s will no longer have to obtain oxygen prior authorizations.

Tentatively, the therapy component included in the 7/1/24 Medicaid rate will be based on prior years therapy claims submitted. Starting with the 2024 cost report submission, SNFs will report the therapy provided to Medicaid only patients by therapy discipline, by HCPC, and by month AND oxygen provided to Medicaid patients by HCPC and by month.

Please watch for further updates as the changes become available.

Skilled Nursing Facility Probe and Educate Review

Skilled Nursing Facility Probe and Educate Review

The MLN Matters article, which is linked below, was published in June 2023 announcing Targeted Probe and Educate Reviews (TPE). In the past month, numerous Kentucky SNFs have reported receiving the reviews.

SNF’s will receive a letter in the mail from CSG regarding the TPE. The reviews can be either Pre- Payment or Post-Payment. If your review is Pre-payment, 5 Part A claims will be in a suspended status.

Medicaid will be enforcing the one year timely filing for claims.

Medicaid will be enforcing the one year timely filing for claims.

An Important Memo from the Department for Medicaid Services

The Department for Medicaid Services (DMS) is reminding Nursing Facility Providers (PT12) and Intermediate Care Facilities for Individuals with Intellectual Disabilities (PT11) of requirements related to timely filing. Per federal regulations, Medicaid must receive claims no more than 12 months from the date of service.

For claims 12 months old or more past the date of service to be considered for processing, the provider must submit documentation demonstrating timely receipt by DMS or Gainwell Technologies along with documentation of subsequent billing efforts.

For pending Medicaid members, aged claims may be considered for payment if filed within one year from the eligibility issuance date. A copy of the KY HealthNet card issuance screen must be attached to the paper claim.

HOT TOPICS: Provider Guidance for Medicaid Renewals

Provider Role in Medicaid Renewals

DMS encourages providers to support their patients undergoing renewals in the following ways:

When is their renewal?

Ensure patients know when their renewal due date is and to be on the lookout for notices from KY Medicaid. Encourage them to keep their contact information current in kynect, including mailing address, telephone number and email address.

How to renew?

Guide patients in completing the steps necessary to respond to notices requiring action before their renewal due date. Help them understand what steps to take to upload information. Connect patients to state-employed kynectors, insurance agents, or state-certified navigators for assistance if needed. Providers may utilize content on the KY Public Health Emergency Unwinding website to support understanding of actions to be taken.

What to do if they are administratively terminated?

While the state is taking steps to ensure that this won’t happen, there may be some patients whose coverage ends even though they may be eligible for Medicaid. A lack of providing information or response prior to their renewal due date will lead to DMS being unable to determine eligibility and renew their coverage. For these patients, providers are encouraged to connect these individuals with kynectors, insurance agents, or state-certified navigators to support them in identifying and submitting all necessary materials for redetermination. If done within 90 days after their end date, the patient could be retroactively reinstated without a gap in coverage. Patients also have 90 days to appeal the administrative termination.

What if they are determined ineligible?

For patients discontinued due to no longer being Medicaid eligible, providers may help individuals understand alternative options for health care coverage, including the state’s Qualified Health Plans (QHPs) available at kynect.ky.gov. Connect patients to state-employed kynectors, insurance agents and state-certified navigators to assist.

PHE Renewal Plan

The state anticipates completing renewals for over 1.6 million individuals. The KY Medicaid renewal process will start in April for those individuals with a renewal due by May 31, 2023. DMS will send notices to individuals going through renewals no fewer than 60-days in advance of their renewal date. Through working closely with patients, providers can determine the specific circumstances for their ongoing renewal and support them in understanding the importance of completing the steps required and ways to do so.

Renewals will follow one of three paths:

Passive Renewals.

Medicaid members for which DMS can verify eligibility through existing data sources will be “passively” renewed. Rather than receive a renewal package, individuals who are passively renewed will receive a Notice of Eligibility. Individuals will not be required to take any further action.

Request for Information.

If the state is unable to verify information, an individual may receive a Request for Information (RFI) to support the renewal process. The individual will need to take action by verifying information before eligibility is re-determined.

Active Renewals.

Medicaid members for which DMS does not have sufficient information available to determine the individual’s eligibility will receive a Renewal Packet 60 days in advance of their eligibility review. Individuals will need to take action to upload additional documentation to support re-determining their eligibility.

PHE Renewal Caseload Mix

The caseload of individuals requiring active renewal will be distributed across a 12-month period (May 2023 – April 2024). DMS’ Renewal Distribution Plan has aligned renewal dates for members of the same household as well as aligned Medicaid and SNAP renewal dates.

DMS has prioritized the following populations:

• Medicare-eligible (May to October)

• QHP-eligible (July to April)

• Children under 19 years of age (July to April)

All other populations will be assigned a month for renewal based on the state’s random renewal realignment algorithm. The table below provides the anticipated caseload breakdown, as a percentage of the total population, for the 12-month renewal timeline.

How to Help Patients During the Renewal Process

While working with patients, providers are encouraged to connect their patients to supports in the community to make sure they know how to respond to any notices. There are numerous ways to submit information and many people in the community that can help.

Join Us in Support of Kentucky Nursing Homes by Contacting Your Representatives and Senators

Join us in support of Kentucky nursing homes by contacting your representatives and senators

Kentucky nursing homes are suffering immensely. At this time, 80.16% of nursing homes are AT RISK for financial distress, while 44.53% are ALREADY facing financial distress. This, combined with continued staffing issues and rising costs could mean many nursing homes are at risk for closing across the state.

There are 31 counties projected to be at risk or in distress that contain only one skilled nursing home.

Did you know? There are an average of 210 Kentuckians who are being admitted or readmitted into nursing homes daily.

So, what is the solution?

Join us in support of Kentucky nursing homes by contacting your representatives and senators.

Click here to view the high quality PDF of the graphic above.

Do you have questions? You may call us at (270) 726-4033 or email us at: accountants@hargisandassociates.com

Sarah McIntosh, President

Resources: Proposed Tax Relief Bill, Screening Risk Change for Skilled Nursing Facilities and Hospice Providers and Medicaid Therapy Reimbursement Changes

Proposed tax relief bill disallows ERC after January 31

The proposed Tax Relief for American Families and Workers Act of 2024 includes disallowing employee retention credit (ERC) claims filed after Jan. 31, 2024. The ERC provision will offset other items in the bill including restoring Sec. 174 (R&E) expensing, enhancements to the child tax credit and other tax relief provisions. It will also allow the IRS to take meaningful action against the pervasive fraud that has plagued the ERC program. While there is a chance that this tax package will not pass and be signed into law, members may want to consider filing any outstanding claims immediately since there is enough Congressional concern about the ERC program that lawmakers could pass a stand-alone bill to end the program early.

Notice of Screening Risk Change for Skilled Nursing Facilities and Hospice Providers

For Skilled Nursing Facilities:

Kentucky Medicaid has been notified of a screening risk level change in 42 C.F.R. § 424.518. for Skilled Nursing Facilities (SNFs) effective Jan. 1, 2023.

As of Jan. 1, 2023, SNFs enrolling or undergoing a change in ownership were elevated from the “limited” level of categorical screening to the “high” screening level. The final rule effectuating this change was published in the Federal Register on Nov. 18, 2022

For Hospice Providers:

Kentucky Medicaid has been notified that effective Jan. 1, 2024, newly enrolling hospices have been elevated from the “moderate” to the “high” screening level.

As of Jan. 1, 2024, Hospice providers enrolling or undergoing a change in ownership shall be elevated from the “limited” level of categorical screening to the “high” screening level. The final rule effectuating this change was published in the Federal Register on Nov. 13, 2023

Additional details can be found on the Department for Medicaid Services website.

Change to Medicaid Therapy Reimbursement for Medicaid Only Patients

Medicaid reimburses therapy and laboratory/radiology services separately for Medicaid only patients (patients without Medicare B). Department for Medicaid Services (DMS) is tentatively planning to cease reimbursing therapy separately and include therapy as a line item in the 7/1/24 SNF rate.

This will be advantageous for SNFs in several ways.

1. Medicaid can pay higher overall rates. The inclusion of therapy increases the Upper Payment Limits.

2. SNFs will no longer have to bill Medicaid for therapies.

3. SNFs will no longer have to obtain therapy prior authorizations.

Tentatively, the therapy component included in the 7/1/24 Medicaid rate will be based on prior years therapy claims submitted. Starting with the 2024 cost report submission, SNFs will report the therapy given to Medicaid only patients by therapy discipline, by HCPC, and by month.

Please watch for further updates as the changes become available.

HOT TOPICS: Provider Role in Medicaid Renewals

Provider Role in Medicaid Renewals

DMS encourages providers to support their patients undergoing renewals in the following ways:

When is their renewal?

Ensure patients know when their renewal due date is and to be on the lookout for notices from KY Medicaid. Encourage them to keep their contact information current in kynect, including mailing address, telephone number and email address.

How to renew?

Guide patients in completing the steps necessary to respond to notices requiring action before their renewal due date. Help them understand what steps to take to upload information. Connect patients to state-employed kynectors, insurance agents, or state-certified navigators for assistance if needed. Providers may utilize content on the KY Public Health Emergency Unwinding website to support understanding of actions to be taken.

What to do if they are administratively terminated?

While the state is taking steps to ensure that this won’t happen, there may be some patients whose coverage ends even though they may be eligible for Medicaid. A lack of providing information or response prior to their renewal due date will lead to DMS being unable to determine eligibility and renew their coverage. For these patients, providers are encouraged to connect these individuals with kynectors, insurance agents, or state-certified navigators to support them in identifying and submitting all necessary materials for redetermination. If done within 90 days after their end date, the patient could be retroactively reinstated without a gap in coverage. Patients also have 90 days to appeal the administrative termination.

What if they are determined ineligible?

For patients discontinued due to no longer being Medicaid eligible, providers may help individuals understand alternative options for health care coverage, including the state’s Qualified Health Plans (QHPs) available at kynect.ky.gov. Connect patients to state-employed kynectors, insurance agents and state-certified navigators to assist.

PHE Renewal Plan

The state anticipates completing renewals for over 1.6 million individuals. The KY Medicaid renewal process will start in April for those individuals with a renewal due by May 31, 2023. DMS will send notices to individuals going through renewals no fewer than 60-days in advance of their renewal date. Through working closely with patients, providers can determine the specific circumstances for their ongoing renewal and support them in understanding the importance of completing the steps required and ways to do so.

Renewals will follow one of three paths:

Passive Renewals.

Medicaid members for which DMS can verify eligibility through existing data sources will be “passively” renewed. Rather than receive a renewal package, individuals who are passively renewed will receive a Notice of Eligibility. Individuals will not be required to take any further action.

Request for Information.

If the state is unable to verify information, an individual may receive a Request for Information (RFI) to support the renewal process. The individual will need to take action by verifying information before eligibility is re-determined.

Active Renewals.

Medicaid members for which DMS does not have sufficient information available to determine the individual’s eligibility will receive a Renewal Packet 60 days in advance of their eligibility review. Individuals will need to take action to upload additional documentation to support re-determining their eligibility.

The caseload of individuals requiring active renewal will be distributed across a 12-month period (May 2023 – April 2024). DMS’ Renewal Distribution Plan has aligned renewal dates for members of the same household as well as aligned Medicaid and SNAP renewal dates.

DMS has prioritized the following populations:

• Medicare-eligible (May to October)

• QHP-eligible (July to April)

• Children under 19 years of age (July to April)

All other populations will be assigned a month for renewal based on the state’s random renewal realignment algorithm. The table below provides the anticipated caseload breakdown, as a percentage of the total population, for the 12-month renewal timeline.

IRS Offers Guidance on Emergency Savings Accounts

IRS Offers Guidance on Emergency Savings Accounts

The Internal Revenue Service provided initial guidance to aid employers in establishing pension-linked emergency savings accounts, an outgrowth of the wide-ranging SECURE 2.0 Act of 2022.

Article by Michael Cohn, AccountingToday.

Do you have questions? You may call us at (270) 726-4033 or email us at: accountants@hargisandassociates.com

Melodie G Bingham, CPA, Sr. Accountant

Resources: CMS Global PHE and KY Department for Medicaid Services PDPM

CMS Developed Global Public Health Emergency (PHE)

Some denial reasons are as follows:

CMS developed three applications to facilitate visitation and prevent the spread of COVID-19 infection. These one-time grants will continue beyond the PHE to allow all certified nursing facilities access to the products. CNFs can apply for all three programs for up to a total of $9,000.

Communicative Technology: Up to $3,000 for tablets and accessories to allow residents to communicate remotely with family and friends

Visitation I: Up to $3,000 for in-person visitation aids such as outdoor shelters and clear dividers

Visitation II: Up to $3,000 for portable fans and/or room air cleaners with HEPA filters (H-13, -14)

KY Department for Medicaid Services - Patient Driven Payment Model

The Kentucky Department for Medicaid Services will be implementing Patient Driven Payment Model (PDPM) rate methodology effective July 1, 2024. Myers & Stauffer has posted a report to the provider web portal.

The report includes a PDPM Medicaid average CMI for MDS assessments active during calendar year 2022. This is NOT the PDPM CMI that will be used for your July 1, 2024 rate. The report is only a snapshot from 2022 for your facility to use for comparison and rate calculation purposes.

PDPM Medicaid average CMI for rates effective 7/1/2024 will use MDS assessments active between 1/1/2024 through 3/31/2024.

The PDPM methodology will be phased in as follows:

As a reminder, rates effective January 1, 2024 and April 1, 2024 will be based on the 7/1/23 through 9/30/23 CMI. The 7/1/23 through 9/30/23 CMI will also be used during the phase in.

Medicare Program: Appeal Rights for Certain Changes in Patient Status

Medicare Program: Appeal Rights for Certain Changes in Patient Status

CMS has issued a new proposed rule, which would mandate that patients be afforded the ability to appeal hospital reclassifications from inpatient to outpatient status.

The proposed processes would consist of the following:

• Expedited appeals: Proposes appeals for certain beneficiaries who disagree with the hospital's decision to reclassify their status from inpatient to outpatient receiving observation services (resulting in a denial of coverage for the hospital stay under Part A

• Standard appeals: Proposes that beneficiaries who do not file an expedited appeal would have the opportunity to file a standard appeal (that is, an appeal requested by a beneficiary eligible for an expedited appeal, but filed outside of the expedited timeframes) regarding the hospital's decision to reclassify their status from inpatient to outpatient receiving observation services (resulting in a denial of coverage for the hospital stay under Part A).

• Retrospective appeals: Proposes retrospective review process for certain beneficiaries to appeal denials of Part A coverage of hospital services (and certain SNF services, as applicable), for specified inpatient admissions involving status changes that occurred prior to the implementation of the prospective appeals process, dating back to January 1, 2009.

Important Information from Our Call with the Department for Medicaid Services

Call with the Department for Medicaid Services

We recently had a call with the Department for Medicaid Services (DMS) to discuss Medicaid pending issues. We discussed multiple denial issues with DMS and we have been instructed to have providers email the issues to: dfs.medicaid@ky.gov.

If a facility needs to report that someone has been erroneously terminated when they should have been extended, they can email: DMS.Eligibility@ky.gov. ONLY cases where the case should be extended because the member hasn’t responded and they are within the three- month extension period, or it should have been extended because there was a pending state task are to be sent to the DMS email box.

Do you have questions? You may call us at (270) 726-4033 or email us at: accountants@hargisandassociates.com

Makayla Strode, Accountant

Resources: Kentucky Medicaid Claims and Denials, Therapy Services & KX-Modifiers

Kentucky Medicaid Claims and Denials

Many clients have recently mentioned Medicaid claim denials. Many of the denials are related to the Recertifications process.

Some denial reasons are as follows:

• Patient liability missing on KYMMIS

• Incorrect program code (Managed Care listed vs LTC)

• Incorrect Eligibility Group (Global Choices vs Comprehensive Choices)

While there are multiple denial issues we have been instructed by Department for Medicaid services to have providers email the issues to: dfs.medicaid@ky.gov.

If you are erroneously getting Kentucky Medicaid claims denied with reason code 4227 - “REVENUE CODE IS NOT COVERED FOR THIS MEMBER”, you should email the following to get the Program code fixed: MSServices@ky.gov

Therapy Services

Supervision Policy for Physical and Occupational Therapists in Private Practice Since 2005, we’ve required PTs Private Practices and OTs Private Practices (PTPPs and OTPPs, respectively) to provide direct supervision of their therapy assistants. We’re finalizing a regulatory change to allow for general supervision of therapy assistants by PTPPs and OTPPs for remote therapeutic monitoring (RTM) services, starting January 1, 2024.

KX Modifiers

The KX-modifier threshold amounts for CY 2024 are $2,330 for OT services and $2,330 for PT and SLP services combined.

2024 Kentucky Statewide Appraisals

2024 Kentucky Statewide Appraisals

According to 907 KAR 1:065, Kentucky statewide appraisals are to be completed every 5 years. Beginning January 2, 2024, statewide appraisals will be conducted. As in years past, National Valuation Consultants (NVC) will complete the appraisals. Every Kentucky price-based nursing facility should receive a letter from the Department for Medicaid Services (DMS) regarding the appraisal and the cost.

Kentucky Medicaid Documentation Guidelines

Kentucky Department for Medicaid Services

Myers and Stauffer has posted the 2023 Supportive Documentation requirements effective 10/1/23.

Accuracy of the MDS item responses is very important for many reasons: responses guide the care provided to the resident; Quality Measures assist state survey in identifying potential care problems in a nursing facility; Medicare and Medicaid rates are set based on MDS responses.

These Supportive Documentation Requirements apply to all Kentucky Medicaid-certified nursing facilities that are scheduled for PDPM case mix reviews on or after October 1, 2023.

Myers and Stauffer LC is a certified public accounting firm that provides professional accounting, consulting, data management and analysis services to government-sponsored healthcare programs. Myers and Stauffer LC is a contractor for the Kentucky Department for Medicaid Services.

Do you have questions? You may call us at (270) 726-4033 or email us at: accountants@hargisandassociates.com

Sarah McIntosh, President

Resources: Kentucky Medicaid, Medicare B Fee Schedule, Training & More

Kentucky Medicaid December Recertifications

DMS is redistributing most renewals in December to other months in the unwinding period. However, there will still be some renewals in December. If a member’s renewal is aligned to another program such as SNAP or TANF, and that program’s renewal is in December, then the Medicaid renewal will stay in December.

Medicare B Fee Schedule Amounts

The Medicare B fee schedules for 2024 have been posted. On average, the fee schedules are decreasing by 3%-4%. Below is a link to CGS website.

Click here to visit the CGS website.

Team Kentucky - Essette Provider Portal / Training

The Cabinet for Health and Family Services (CHFS) Department for Medicaid Services (DMS) has partnered with Gainwell Technologies to implement and maintain a comprehensive Utilization Management (UM) program for Kentucky’s Fee-For-Service (FFS) members.

Altman Z Map

Altman Z Map

The Altman Z-score can be used to predict financial distress within the nursing home industry. Financial variables used to measure liquidity, profitability, efficiency, and net worth are utilized in the calculation.

The Altman Z score considers the balance sheet strength and operational success of a facility. The map below shows the county averages for Kentucky. The scores are calculated using data from the 2022 Medicare cost reports and the modified Altman Z-score from Justin Lord, PHD published in the Journal of Health Care Organization, Provision, and Financing.

Click here to view a high quality PDF of the map.

Do you have questions? You may call us at (270) 726-4033 or email us at: accountants@hargisandassociates.com

Kyle Fritsch and Leah Shoulders, Directors of Revenue Management

Resources: Kentucky Medicaid Programs and Reminders

Essette Provider Portal

Kentucky Medicaid Utilization Management Program

In June 2023, The Cabinet for Health and Family Services (CHFS) and Department for Medicaid Services (DMS) announced the implementation of a Utilization Management (UM) program for Kentucky’s Fee-For-Service (FFS) members. The new UM program is Essette. Kentucky SNFs will use this program for Prior Authorizations for ancillaries (Oxygen, Physical Therapy, Occupational Therapy and Speech Language). The program is optional to use but will be at the facilities advantage to have an electronic program vs faxing.

The tentative Go Live date is 11/13/2023.

Click here to view the Memo for Trainings and additional information.

Reminder: 30 Days of Bedhold for Kentucky Medicaid

In June 2023, CMS granted approval for Kentucky Department of Medicaid Services to extend the bed hold and bed reserve reimbursement through the unwinding period. Providers will continue to be paid for 30 days of bed hold and 75% of the NF rate if occupancy is less than 95% through the unwinding process.

CMS Improper Payment Probe May Impact Timely Reimbursement for Nursing Homes.

Probe & Education Review Letters

Skilled Nursing Facilities are beginning to receive letters from CMS/CGS regarding the Probe and Educate review process. CMS will have its auditors conduct reviews of five claims per SNF – providers with an error rate of 20% or less will receive education of some kind, while those with an error rate greater than 20% will receive one-on-one education with a Medicare Area Contractor (MAC). MACs were directed to start with providers that show the highest risk. See articles below.

Click here to view the CMS Manual System.

Click here to view the updated Memo from CMS.

Do you have questions? You may call us at (270) 726-4033 or email us at: accountants@hargisandassociates.com

Leah Shoulders, Director of Revenue Management

Resources: DDE PPTN Recertification Deadline, Prior Authorization Utilization and Kentucky CMI Map

Upcoming Deadline: Annual DDE PPTN Recertifcation

Annual DDE PPTN Recertification Deadline: September 30th

A total of 1,920 DDE/PPTN users did not complete the annual recertification process by August 31st. To ensure DDE/PPTN access is not terminated for these users, CGS is extending the deadline to September 30, 2023. If you still haven't recertified, please complete and submit the Annual DDE PPTN Recertification form today!

After September 30th, CGS must terminate your access. Once terminated, you must submit the J15 DDE PPTN Application/Reactivation form to regain access, and the normal 20 business days for processing applies.

Upcoming Enhanced Prior Authorization/Utilization Management Process

Dear Medicaid Provider,

The Department for Medicaid Services (DMS) is excited to bring the provider community a new platform for requesting and managing prior authorizations for your fee-for-service members. This enhancement is currently slated for early fall and can be accessed by the using the Kentucky Online Gateway (KOG).

In preparation, DMS needs to ensure that the correct provider staff are identified as the Organization Administrator (Org Admin) for the new provider portal where prior authorizations for fee-for-service members will be requested and managed. You have been identified as a current Organization Administrator for a Kentucky Medicaid Provider and DMS requests that you answer the brief survey below. This will help our technical team get the correct staff set up prior to or at the new platform go-live.

Click here to access the survey.

Kentucky CMI Map

Case Mix measures the acuity level of a facility's resident population. The Medicaid Case Mix adjusts the Direct Service and Non-Personnel Operating components of the Medicaid Rate. Effective with the 7/1/23 rates, every .1 increase in Case Mix results in a $9.73 increase in rural Medicaid rates and a $11.48 increase in urban Medicaid rates.

Click here to view a high quality PDF of the map.

Make sure to update your VBP Score.

Make sure to update your VBP Score

As of 10/1/23 the Medicare Rates will be updated. CMS estimates that the aggregate impact of the payment policies in this rule would result in a net increase of 4%. The SNF wage index is different for each urban and rural Core-Based Statistical Area.

While most AR systems update the Medicare rates, they do not update the facility specific Value-Based Purchasing (VBP) score. Each facility must download and update their individual VBP score. If the appropriate VBP score is not entered into your AR system, the AR will not be calculated correctly. The VBP incentive score was frozen at .9920 during COVID. As of 10/1/23, the VBP for each SNF is back in effect. Below are instructions to share with your facility on how to locate this report.

Instructions for Locating your VBP Report

To locate your new report in iQIES, please follow the instructions listed below:

1. Log into iQIES using your Health Care Quality Information Systems (HCQIS) Access Roles and Profile (HARP) user ID and password.

a. If you do not have a HARP account, you may register for a HARP ID using the link below.

2. In the Reports menu, select My Reports.

3. From the My Reports page, locate the MDS 3.0 Provider Preview Reports folder. Select the MDS 3.0 Provider Preview Reports link to open the folder.

4. Here you can see the list of reports available for download. Locate the desired SNF VBP Program Quarterly Confidential Feedback Report.

5. Once located, select More next to your desired SNF VBP Program Quarterly Confidential Feedback Report and the report will be downloaded through your browser. Once downloaded, open the file to view your facility’s report.

For additional questions about accessing your SNF’s report, which can only be accessed in iQIES, please contact the QIES/iQIES Service Center by phone at (800) 339-9313 or send an email to iqies@cms.hhs.gov.

Click here to register for a HARP ID.

For more information about the SNF VBP Program, please visit the CMS website.

Do you have questions? You may call us at (270) 726-4033 or email us at: accountants@hargisandassociates.com

Resources: Recertify FISS DEE, Form I-9 Updates, Medicaid Errors and Medicaid Rates

Don’t Delay: Recertify Your FISS DDE Access Today!

Have you recertified your Fiscal Intermediary Standard System (FISS) Direct Data Entry (DDE)? The deadline to do so is August 31, 2023.

If you don’t complete the recertification process timely, your FISS DDE access will be terminated. Once terminated, you will need to submit the J15 DDE PPTN Application/Reactivation form and the normal 20 business days to process a new application will apply.

Don’t wait for your access to be terminated.

USCIS to Publish Revised Form I-9

On July 21, U.S. Citizenship and Immigration Services (USCIS) announced they will soon publish a revised version of Form I-9 (Employment Eligibility Verification). The revised Form I-9 (edition date 8/01/23) was published on uscis.gov on August 1, 2023. The agency notes that employers can use the current Form I-9 (edition date 10/21/19) through October 21, 2023. Staring November 1, 2023, all employers must used the new Form I-9.

Click here to visit the USCIS webpage for additional information.

Medicaid Errors with July 2023 Claims

Some SNF’s are having their July Medicaid claims denied due to patient liability. Savannah Wiley at KAHCF has contacted the Department for Medicaid Services (DMS) and they are aware of the error.

DMS stated that the June renewals that were pushed to July are receiving an error with their patient liability as of 7/1. The patient liability is coded as Global Choices vs Comprehensive, and this is causing the July claims to deny.

If you are having this issue, first contact your local office. If the local office is not able to fix this error, email the following and ask them to fix.DFS.Medicaid@ky.gov

Medicare Rates

To receive your final FY 2024 Medicare rates contact one of our accountants today. in order to prepare your SNFs report, we will need to your VBP report and any QRP letters (if applicable).

Do you have questions? You may call us at (270) 726-4033 or email us at: accountants@hargisandassociates.com

Fiscal Year (FY) 2024 Skilled Nursing Facility Perspective Payment System Final Rule - CMS-1779-F

Fiscal Year (FY) 2024 Skilled Nursing Facility Perspective Payment System Final Rule - CMS-1779-F

On July 31, 2023, the Centers for Medicare & Medicaid Services (CMS) issued a final rule that updates Medicare payment policies and rates for skilled nursing facilities under the Skilled Nursing Facility Prospective Payment System (SNF PPS) for fiscal year (FY) 2024. CMS estimates that the aggregate impact of the payment policies in this rule would result in a net increase of 4.0%. The final rule also includes updates to the SNF Quality Reporting Program (QRP) and the SNF Value-Based Purchasing (VBP) Program for FY 2024 and future years, including the adoption of a measure intended to address staff turnover.

For more information, please visit the CMS website.

Do you have questions? You may call us at (270) 726-4033 or email us at: accountants@hargisandassociates.com

Rhonda Houchens, Director of Operations

Resources: VBP Report

Instructions for Locating your VBP Report

To locate your new report in iQIES, please follow the instructions listed below:

1. Log into iQIES using your Health Care Quality Information Systems (HCQIS) Access Roles and Profile (HARP) user ID and password.

a. If you do not have a HARP account, you may register for a HARP ID using the link below.

2. In the Reports menu, select My Reports.

3. From the My Reports page, locate the MDS 3.0 Provider Preview Reports folder. Select the MDS 3.0 Provider Preview Reports link to open the folder.

4. Here you can see the list of reports available for download. Locate the desired SNF VBP Program Quarterly Confidential Feedback Report.

5. Once located, select More next to your desired SNF VBP Program Quarterly Confidential Feedback Report and the report will be downloaded through your browser. Once downloaded, open the file to view your facility’s report.

For additional questions about accessing your SNF’s report, which can only be accessed in iQIES, please contact the QIES/iQIES Service Center by phone at (800) 339-9313 or send an email.

Click here to register for a HARP ID.

For more information about the SNF VBP Program, please visit the CMS website.

July 1, 2023 Medicaid Rates

July 1, 2023 Medicaid Rates

Kentucky Skilled Nursing Facilities should be receiving their 7/1/2023 Medicaid rates any time. Medicaid has granted the Price Based Nursing Facilities a 3.0% inflationary adjustment to the price components of the rate, 8.94% increase to the Capital rate component, and a 6.5% “catch-up” adjustment.

Do you have questions? You may call us at (270) 726-4033 or email us at: accountants@hargisandassociates.com

Debbie Dwyer, Billing Specialist

Resources: Medicare Credit Balance Reports, ABN Form Renewal, Utilization Management and more

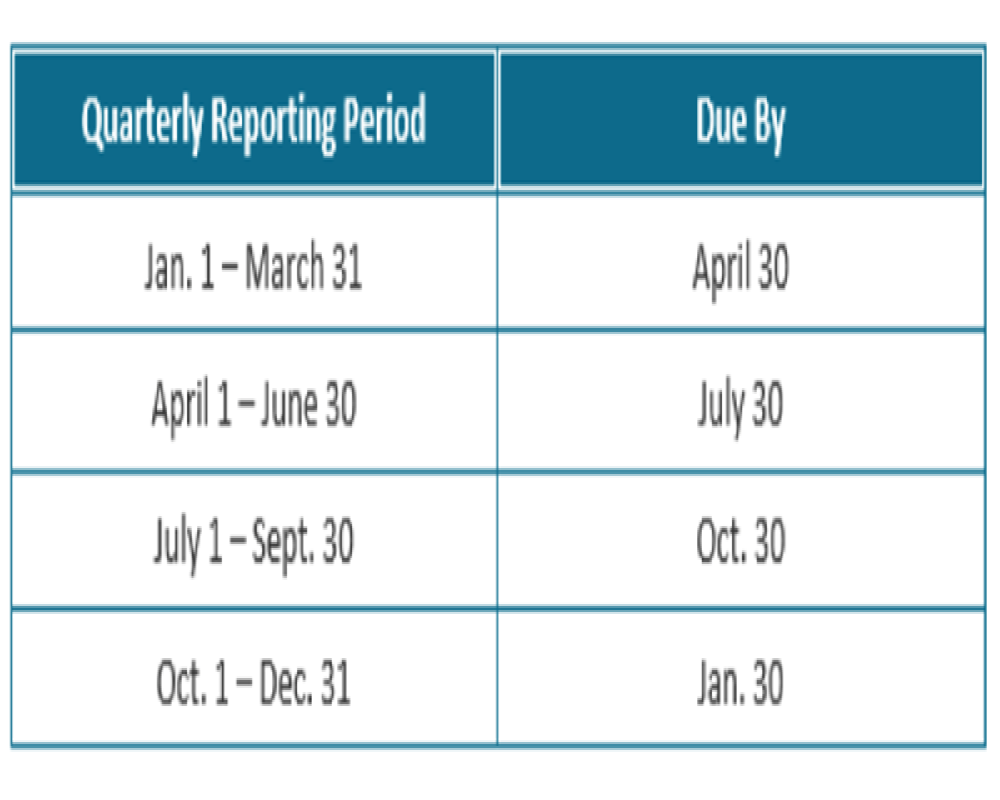

Reminder: Medicare Credit Balance Reports Due

As a reminder, the Medicare Credit Balance Report for the quarter ending June 30th is due by July 30, 2023.

ABN Form Renewal

The Office of Management and Budget approved the Advance Beneficiary Notice of Noncoverage (ABN) (Form CMS-R-131 (ZIP)) and instructions (PDF) for renewal. You must use the renewed form with the expiration date of June 30, 2023, beginning August 31. There are no other changes to the form. Visit the ABN webpage for more information.

Click here to download Form CMS-R-131.

Click here to visit the ABN website.

New Kentucky Utilization Management Program

The Cabinet for Health and Family Services (CHFS) Department for Medicaid Services (DMS) has partnered with Gainwell Technologies to implement an automated prior authorization (PA) system for Nursing Facility Ancillary services. The automated PA system will offer a more efficient process that allows a member to begin treatment sooner and allows providers to receive a determination and start services much quicker.

All providers who submit PA requests will need to attend the training. Providers can register for virtual trainings at bit.ly/KYUMTraining. Providers will need to register for a free account and select Provider as your curriculum.

Tentative Go Live date is October 16, 2023.

Click here to view the memo from DMS.

Final MDS 3.0 Item Sets Version1.18.11 v4 Now Available

The final Minimum Data Set (MDS) 3.0 Item Sets version (v)1.18.11 have been updated and are now available in the Downloads section on the Minimum Data Set (MDS) 3.0 Resident Assessment Instrument (RAI) Manual page. The IPA, NP, and SP Item Sets have been replaced with revised versions; the remaining item sets remain unchanged from the last posted version. The MDS Item Sets v1.18.11 will be effective beginning October 01, 2023.

Click here to view the MDS 3.0 Resident Assessment Instrument Manual.

Kentucky - Extension of Bedhold days has been Approved by CMS

Kentucky - Extension of Bedhold days has been Approved by CMS

Veronica Judy-Cecil, Senior Deputy Commissioner reported on June 14th that Kentucky Department for Medicaid Services requested an increase in bedhold days from 14 to 30 AND an increase in bed reserve reimbursement to 75% of the facility's rate if occupancy rate is below 95%.

CMS has granted the approval. The increases will be retroactive to 5/11/23.

Do you have questions? You may call us at (270) 726-4033 or email us at: accountants@hargisandassociates.com

Rhonda Houchens, Director of Operations

Resources: Section G

Section G

CMS announced last fall section G’s removal from the comprehensive OBRA item set starting October 1, 2023. The removal of this key section from the Minimum Data Set (MDS) will impact the future of nursing home reimbursements by states. Every state is evaluating different methods.

During the Kentucky quarterly meeting of the Nursing Facility Technical Advisory Committee, Kentucky Department for Medicaid Services (DMS) was asked about Section G going away on 10/1. DMS is evaluating the possibilities and researching what other states are going to implement. DMS stated their “goal” is to not have SNFs completing Optional State Assessments (OSA).

We will keep you informed of any updates.

If you need assistance, please contact our office. Call us at (270) 726-4033.

Good News - Increases to our Medicaid Rates!

Good News - Increases to our Medicaid Rates!

Governor Beshear held a press conference yesterday to announce the increase to the 7/1/23 Medicaid rates. After a call with the Cabinet, we have clarification on how the rates increase will be calculated. Medicaid has granted the Price Based Nursing Facilities a 3.0% inflationary adjustment to the price components of the rate, 8.94% increase to the Capital rate component, and a 6.5% “catch-up” adjustment.

If you would like Hargis to calculate your ACTUAL 7/1/23 Medicaid rate, please send the following:

• 4/1/23 Medicaid rate notice

• January thru March 2023 CMI

Please contact our office at (270) 726-4033.

Sarah McIntosh, President

Improper Payment Probe

Improper Payment Probe

All skilled nursing facilities that participate in Medicare Fee-for-Service (FFS) can expect a letter from the Centers for Medicare & Medicaid Services (CMS) regarding improper payment rates starting June 5. CMS will have its auditors conduct reviews of five claims per SNF – providers with an error rate of 20% or less will receive education of some kind, while those with an error rate greater than 20% will receive one-on-one education with a Medicare Area Contractor (MAC). MACs were directed to start with providers that show the highest risk. See articles below.

Click here to view the CMS Manual System.

Click here to view the Skilled Nursing News article.

If you need assistance, please contact our office. Call us at (270) 726-4033.

Sarah McIntosh, President

Resources: COVID-19 Expiration Questions

Questions after the COVID-19 expiration? Our team is prepared and ready!

Due to the pandemic, the healthcare industry has experienced many changes, revisions and addendums the past three years. We know it can cause confusion as you try to work your way through all the changes. We don't want you to miss a deadline or an opportunity to help your community. For your convenience, we have shared important resources below, and as always, our team is available to offer guidance for the expiration of the COVID-19 Public Health Emergency (PHE).

If you need assistance, please contact our office. Call us at (270) 726-4033.

Kentucky Medicaid Renewal Report

As of April 30, 2023, Kentucky nursing facilities and intermediate care facilities will be able to generate a Medicaid Renewal Report listing all individuals with Medicaid Eligibility that are due for Medicaid Renewals.

Click here for the Medicaid Renewal Report for KLOCS Providers.

COVID-19 Notification Requirements

CMS confirmed the requirement to notify all residents and their representatives about COVID-19 cases (F885) ended Monday, May 1, 2023.

Kentucky Medicaid $270 Add-On Ended

Due to the Public Health Emergency (PHE) ending, the last date of service for Revenue Code 550 ($270 COVID-19 add on reimbursement) was May 11, 2023. As of May 12, 2023, claims with Revenue Code 550 will not be paid and providers may need to split the bill for May dates of service.

Resources: 3 Day Stay Waivers, Fiscal Year (FY) 2024 and more

3 Day Stay Waivers end May 11, 2023

The end of the COVID-19 public health emergency (PHE) is May 11, 2023. For resident admissions prior to May 11, 2023, the 3 Day waiver can still be utilized with condition code DR. All admissions after May 11, 2023, will be required to have a 3 day hospital stay to be reimbursed.

Kentucky Medicaid $270 Add-On

Due to the Public Health Emergency (PHE) ending, the last date of service for Revenue Code 550 ($270 COVID-19 add on reimbursement) will be May 11, 2023. As of May 12, 2023, claims with Revenue Code 550 will not be paid and providers may need to split the bill for May dates of service.

Fiscal Year (FY) 2024 Skilled Nursing Facility Prospective Payment System Proposed Rule (CMS 1779-P)

On April 4, 2023, the Centers for Medicare & Medicaid Services (CMS) issued a proposed rule that would update Medicare payment policies and rates for skilled nursing facilities under the Skilled Nursing Facility Prospective Payment System (SNF PPS) for fiscal year (FY) 2024. In addition, the proposed rule includes proposals for the SNF Quality Reporting Program (QRP) and the SNF Value-Based Purchasing (VBP) Program for FY 2024 and future years. CMS estimates that the aggregate impact of the payment policies in this proposed rule would result in a net increase of 3.7%, or approximately $1.2 billion, in Medicare Part A payments to SNFs in FY 2024.

Click here for complete details.

Center of Excellence for Behavioral Health in Nursing Facilities

On the April 13, 2023 CMS SNF/LTC Open Door Forum, an overview of the Center of Excellence for Behavioral Health in Nursing Facilities was shared. We encourage you to review their website and available resources.

Click here to visit the center's website.

CERT Review Contractor name change

The Comprehensive Error Rate Testing (CERT) Review Contractor, formerly known as NCI Information Systems, Inc. changed their company name to Empower AI, Inc.

Advance Beneficiary Notice of Noncoverage: Form Renewal

The Office of Management and Budget approved the Advance Beneficiary Notice of Noncoverage (Form CMS-R-131) for renewal. This renewed form expires January 31, 2026. The expiration date is the only change to the form. You may use the renewed form now, but you must use it beginning June 30, 2023, when the previous version expires.

Kentucky Medicaid Renewal Report

As of April 30, 2023, Kentucky nursing facilities and intermediate care facilities will be able to generate a Medicaid Renewal Report listing all individuals with Medicaid Eligibility that are due for Medicaid Renewals.

Click here for the Medicaid Renewal Report for KLOCS Providers.

Oxygen - Kentucky Medicaid 2023

Oxygen - Kentucky Medicaid 2023

Kentucky Medicaid reimburses SNF’s for approved ancillary billing codes. The ancillary payment methodology is outlined in 907 KAR 1:065, section 12. The current KY Medicaid allowable oxygen procedure codes for skilled nursing facility services are listed below.

Oxygen is reimbursed to the skilled nursing facility based on the durable medical equipment fee schedule. The oxygen fee schedules were updated in Medicaid as of 2/1/23.

If you need assistance, please contact our office. Call us at (270) 726-4033.

Public Health Emergency (PHE) ends on May 11, 2023

Public Health Emergency (PHE) ends on May 11, 2023.

What does this mean for KY Medicaid SNF’s?

• Return to 14 days bed hold days.

• Return to 50% bed reserve reimbursement.

• $270 per diem add-on goes away.

• $29 Rate Add-on DOES NOT go away. The $29 per day Medicaid add-on for Price-Based Nursing Facilities will remain in place until the re-basing occurs.

What does this mean for KY Medicaid recipients with excess resources?

• Kentucky extended the disregard for excess resources for Long Term Care members for 12 months past the PHE. (SPA 22-0012)

Click here to view complete details.

If you need assistance, please contact our office. Call us at (270) 726-4033.

Rhonda Houchens, Director of Operations

Redetermination Date

Redetermination Date

The Kentucky Department for Medicaid Services (DMS) will resume normal operations in alignment with federal laws in May. As part of this effort, DMS will send renewal letters to some Medicaid members beginning in early April 2023 for renewals in May 2023. When the change goes into effect some individuals may be at risk of losing Medicaid eligibility after almost three years of continuous health coverage regardless of changes in their circumstances. DMS' goal is for no one to lose coverage and coordinated efforts are underway to reach all members who will be impacted by this change.

DMS has updated KyHealthNet to include the Redetermination Date for each member.

Medicaid Public Health Emergency Unwinding

Medicaid Public Health Emergency Unwinding

DMS will begin annual renewals for Medicaid members. You may be at risk of losing Medicaid coverage if we cannot reach you. You should update your contact information as soon as possible and keep it updated so Kentucky Medicaid is able to reach you when it is your time to renew!

The renewals will resume in May, but the PHE is still in effect and therefore all the flexibilities that were put in place for providers and members remain in place. When the PHE ends on May 11, 2023, some of these flexibilities will be discontinued (or unwound) and some will continue based on state policy changes.

The Kentucky Department for Medicaid Services (DMS) will resume normal operations in alignment with federal laws in May. As part of this effort, DMS will send renewal letters to some Medicaid members beginning in early April 2023 for renewals in May 2023. When the change goes into effect some individuals may be at risk of losing Medicaid eligibility after almost three years of continuous health coverage regardless of changes in their circumstances. DMS' goal is for no one to lose coverage and coordinated efforts are underway to reach all members who will be impacted by this change.

Please update your information as soon as possible!

Visit kynect.ky.gov or call kynect at 855-4kynect (855-459-6328) to update your mailing address, phone number, email and other contact information. Kentucky Medicaid will then be able to reach you when it is your time to renew!

Click here to view complete details.

If you need assistance, please contact our office. Call us at (270) 726-4033.

Sarah McIntosh, President

KY Public Health Emergency (PHE): Renewal Process

KY Public Health Emergency (PHE): Renewal Process

The Public Health Emergency (PHE) will end 5/11/23. Ky Medicaid will start the renewal process back. Renewals dated 5/31/23 will be the first renewals.

While on 3/22/2023 Ky PHE Stakeholder call, it was mentioned that the renewal dates will be published in KyHealthNet. By March 25, 2023, KyHealthNet will reflect the updated renewal dates for all members. The renewals dates can be viewed under the Members eligibility section.

Click here to stay updated with the renewal process.

Oxygen Prior Authorizations Common Denials

Several SNF’s have recently had issues with Medicaid denying their oxygen Prior Authorizations. After conversations with Carewise, there are a couple of main denial reasons and suggestions to correct.

The most common denial is “not returning information requested”.

• Once the SNF faxes the prior authorization form to Carewise, they have up to 15 days to respond. Carewise’s normal response time is 5-6 days. A Lack of Information (LOI) letter is mailed to the patient address on file in kymmis. The LOI letter gives 14 days for the SNF to gather the information and get it submitted. This poses a major issue for the SNF’s that never receive the letter and do not know anything else is needed. Carewise has given a solution to this problem. The LOI letters are in Ky Health Net. Also, the SNF can call and inquire about the LOI letter. The number is 1-800-292-2392.

Another common denial is “more current MD order for oxygen”.

• Carewise has stated that the monthly order signed by the physician every other month is sufficient for this request. Carewise has also stated that a verbal order from the physician is acceptable if the SNF notes this process was completed.

Another common denial is “provide qualifying room air oxygen saturation levels”.

• Carewise must receive documentation for the patient’s Room Air AND Oxygen usage. Carewise will accept MARS, TARS, and Nursing Notes.

Kentucky Medicaid Update: Member Renewals

Kentucky Medicaid Update: Member Renewals

An important message from The Department for Medicaid Services’ (DMS).

Kentucky will resume normal enrollment and eligibility operations for Medicaid in alignment with federal laws on May 1. After that date, some Medicaid members who have continuously received benefits during the Public Health Emergency may be at risk of losing Medicaid if they are no longer eligible. The Department for Medicaid Services’ (DMS) goals are to reduce unnecessary loss of coverage for those who are eligible and to support those who are no longer eligible in obtaining alternative coverage.

Coordinated efforts are underway to reach all members who will be impacted by this change.

Medicaid renewals will be processed over the course of 12 months. DMS will notify members about 60 days in advance of their renewal date through multiple forms of communication, including letters, text, and email. As a partner of DMS, there are very important ways that you can help support members through their renewal: