Blog

Click here to go back

Medicaid Quality Incentive Program

Medicaid Quality Incentive Program

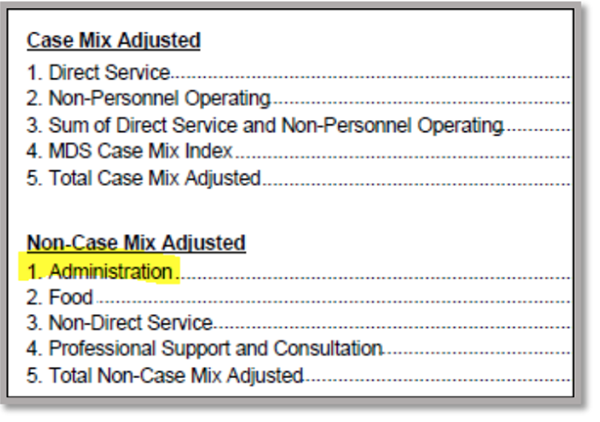

For FY2025 (7/1/24) providers received the full provider tax assessment rate of $41.43. This amount is built into the Administration line of your 7/1/24 Medicaid rate.

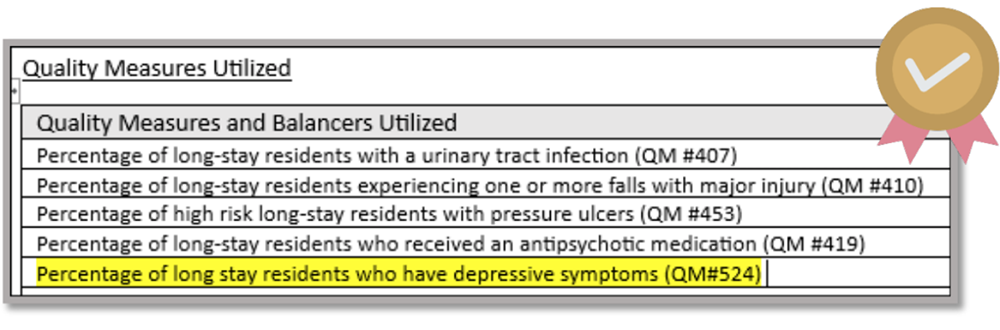

Beginning with FY2026 (7/1/25), the Department for Medicaid Services (DMS) will implement a phase-in of the Quality Incentive Program. The provider tax add-on allowance of $41.43 will be reduced and a quality pool will be created. Providers will earn a quality add-on per diem based on the DRAFT measures below. The highlighted measure is up for discussion.

Myers & Stauffer will post a draft Score card of the quality measures in the portal within the next 2 weeks.

Click here to view a printable PDF.

If you need assistance, please contact our office. Call us at (270) 726-4033.

Sarah McIntosh, President